Community Volunteer Income Tax Program

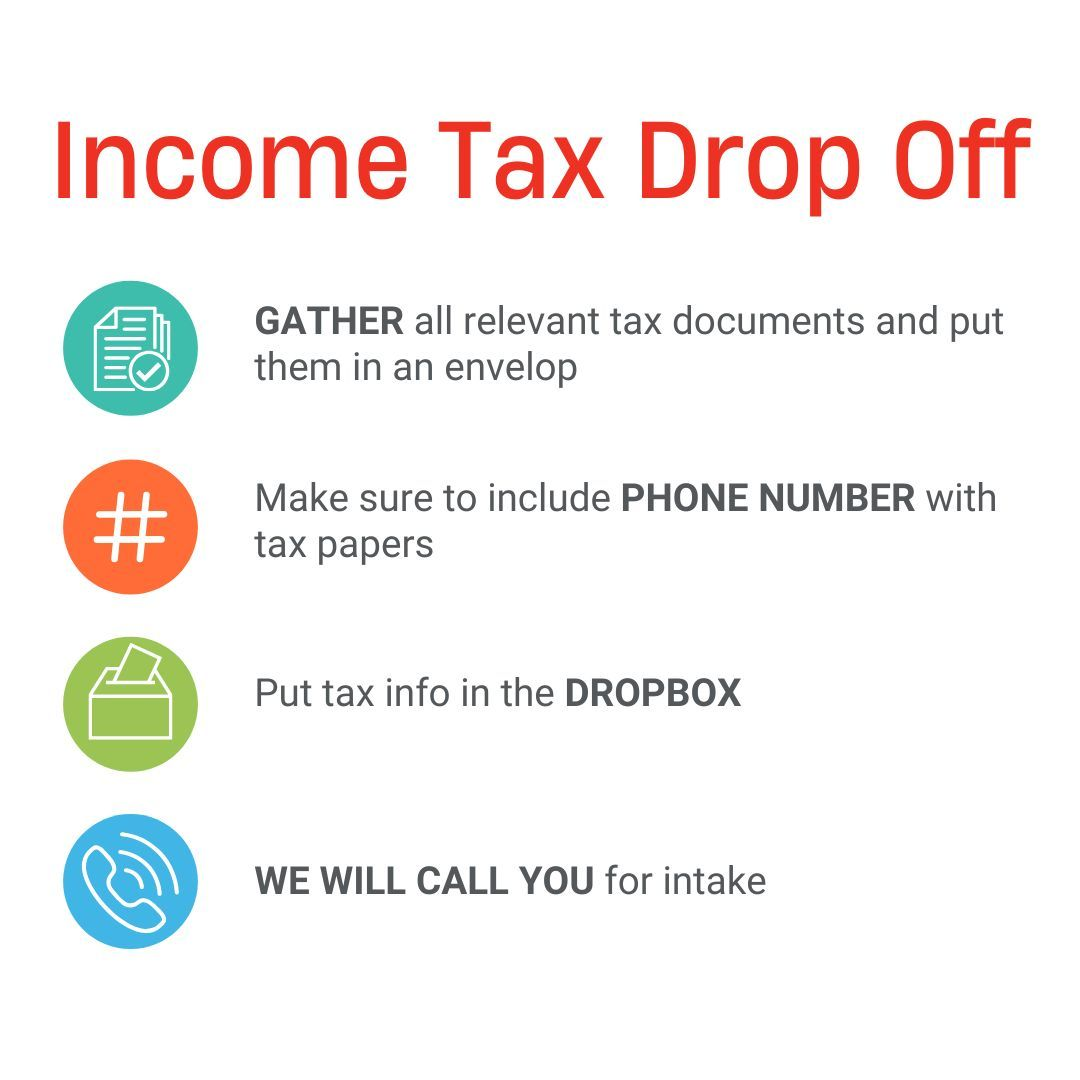

The Community Volunteer Income Tax Program (CVITP) is a free service that helps eligible community members file their income tax returns. Trained volunteers prepare simple tax returns for individuals and families who meet the eligibility criteria outlined below.

This program ensures community members can access important benefits and credits they may be entitled to at no cost.

Eligibility criteria and instructions on how to access the program are provided below.

Eligibility

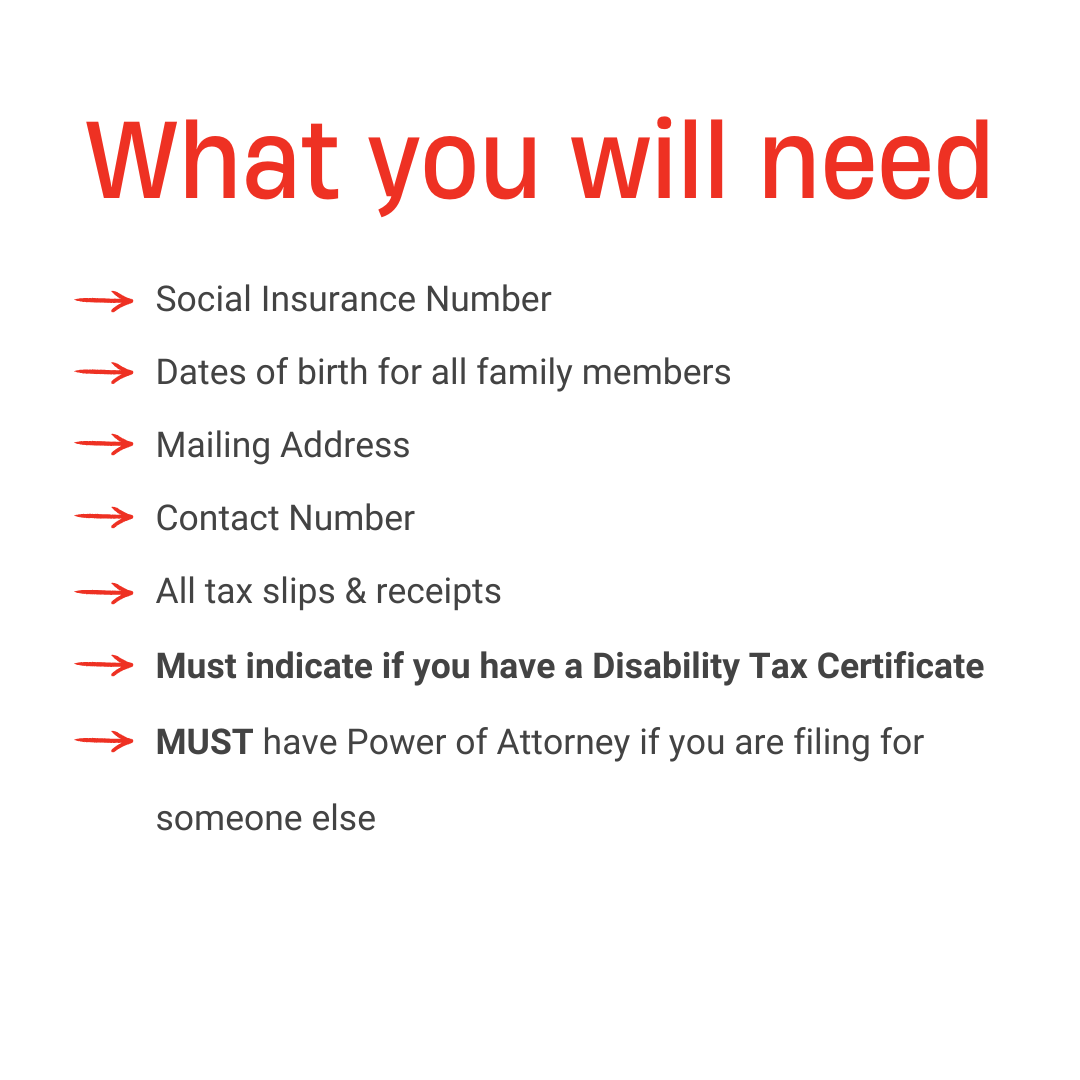

$40,000 & under - individual.

$55,000 & under - married or common law.

An additional $5,000 added to the above total for each dependent.

Non Eligible

- Self employment.

- Renal income and expenses.

- Interest income over $1,200.

- Bankruptcy in the tax year or the year before.

Disclaimer

United Way only submits your tax return electronically. All refunds are issued directly by the CRA, either through direct deposit or by cheque in the mail.

Volunteers Needed – Community Volunteer Income Tax Program

We are currently looking for volunteers to support our Community Volunteer Income Tax Program. If you’re interested in helping individuals and families in our community, we’d love to hear from you. Please click the links below to view more details, and contact us if you have any questions or would like to get involved.

Community Volunteer Income Tax Program Intake Volunteer

Community Volunteer Income Tax Program -Tax Preparer Volunteer